Let me start with some facts:

- The worst stock in the S&P: Generac (down 71.4%)

- The best stock in the S&P: Occidental Petroleum (up 119.1%). Maybe that Warren Buffett guy knows what he’s doing…

- The worst stock in Nasdaq 100: Lucid (down 83.3%, followed closely by Rivian, down 82.1%)

- The best stock in Nasdaq 100: Pinduoduo (up 50.8%)

- The best stock in the Dow: Chevron (up 58.5% – their best return since 1980)

- The worst stock in the Dow: Intel (down 50.3%)

- The best market sector: Energy, up 58% (the only sector to have a gain in 2022). In fact, every single energy stock in the sector was up on the year

- The worst market sector: Communication Services, down 40%. The sector’s worst year ever. You can thank stocks like Alphabet (down 39%), Meta (down 64%), and Disney (down 45%) for that.

A few individual asset stats of note:

- It was the worst year for Apple since 2008 (down 28.6%)

- Worst year for Disney since 1974 (down 44.6%)

- Worst year for Nike since 1997 (down 28.9%)

- Worst year for Verizon since 2005 (down 24.9%)

- Worst year for Cathy Wood’s ARK Innovation ETF ever (down 67.8%)

- Tesla (down 69.2%) had a worse year than Meta (down 64.5%) and Carnival (down 62.4%). It was Tesla’s worst year ever

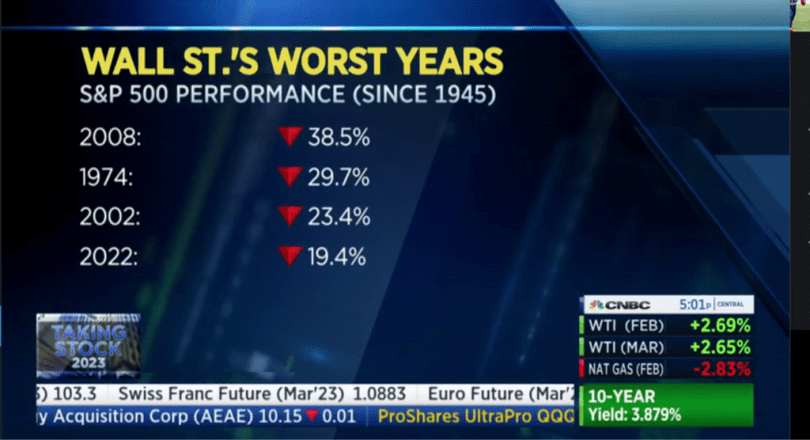

As you can see, stocks are coming off their worst year since 2008 due to investors misjudging how high inflation would soar and the lengths central banks would go to bring it back down.

The headline stat: Global equities lost a record $18 trillion in 2022 amid nearly 300 interest rate hikes from central banks around the world.

But not all stocks were clobbered equally by Jerome Powell and Co.: High-growth tech companies that got a boost from an era of low interest rates got rocked the most in what some are calling the sequel to the bursting of the dot-com bubble in 2000–01. The tech-heavy Nasdaq posted four straight negative quarters for the first time since that crash.

Others survived unscathed. The energy sector soared 59% last year thanks to a boost from surging oil prices. Exxon Mobil finished the year as the eighth-most valuable public company in the US, despite starting 2022 outside the top 25.

So what will this year hold?

No one really knows, but analysts generally think stocks will go sideways, weighed down by more rate hikes and a potential recession. The average Bloomberg projection for the S&P at the end of 2023 is 4,009 points (the index closed 2022 at 3,839.50).

Another down year would be extremely rare: The S&P has dropped for two consecutive years in just four instances since 1928.