One thing I’m certain about the rapid collapse of FTX Trading Ltd. is:

Imagine that you were magically installed as chief executive officer of FTX in, say, late October of 2022, after Alameda borrowed/lost/stole billions of dollars of customer money, but before people noticed and demanded their money back. And your staff came to you and described the whole situation in accurate detail, and then asked you what you wanted to do. Your basic choices were:

- Announce “hey, turns out the previous management misplaced billions of dollars of customer money, we’re looking into it, sorry about that.” And then try to fill the hole as rapidly as possible — by selling cryptocurrency or real estate, by begging to take back donations, by finding new outside investors, etc.

- Announce “FTX is stronger than ever,” reassure customers that everything is great, and launch a new ad campaign to attract more deposits.

I know what I’d choose! If you are an outside candidate magically installed as CEO of a company that has been doing fraud, Option 1 almost certainly avoids personal criminal liability. Not going to prison would be my top priority in any sort of high-finance job, so I would quickly announce my predecessors’ fraud.

On the other hand I do want to recognize that Option 2 might be better for customers and shareholders: You buy yourself some time to make profits and possibly get out of the hole created by the fraud, albeit at the cost of committing more fraud. I don’t recommend it or anything — most of the time, trying to earn your way out of fraud just makes things worse — and if you are not already part of the fraud, it seems pretty insane to jump in and participate. But it would be kind of an interesting move. Whereas Option 1 blows up the firm immediately: FTX is a levered financial institution funded by customer deposits that can (in theory!) be withdrawn at any time, so announcing that it’s a big fraud leads to an immediate run on the bank and bankruptcy.

Weirdly Sergio Rial found himself in more or less this exact situation, but at a retailer. He chose Option 1:

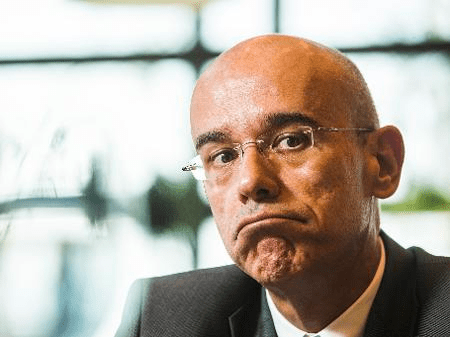

Hours after revealing a scandal that would roil Brazilian markets, Sergio Rial joined a Zoom call with hundreds of panicked investors. It was an attempt to explain the $4 billion accounting gap that pushed him to quit his new job at the helm of retailer Americanas SA. …

Within a week, the company filed for bankruptcy protection with $8.2 billion of debt. …

It was a sharp reversal for a company that had seen its stock rally after Rial was named chief executive officer last August, a job he only started on Jan. 2. Investors thought Americanas, which has been backed by billionaires Jorge Paulo Lemann, Marcel Telles and Carlos Alberto Sicupira for more than four decades, was set for improved performance under the 62-year-old former banker’s leadership.

It unraveled on the night of Jan. 11 when it announced “inconsistencies” that had artificially boosted profits and reduced reported liabilities by half. The company’s disclosures imply it misreported numbers tied to financing of debts with suppliers while also wrongly deducting interest paid to lenders from its liabilities.

In the Thursday bankruptcy protection filing — similar to a Chapter 11 in the US — lawyers for the company said, “due to unexpected reasons that rocked the group’s structure, the petitioners saw their cash and revenue expectations crumble within minutes.” … Wall Street analysts quickly put their ratings under review and ratings firms downgraded the debt, after which banks refused to advance credit card receivables, draining more than 3 billion reais from the company’s cash.

You might naively assume that a big retailer would not be subject to a run on the bank: You announce “hey we did a lot of fraud,” the stock goes down, but you still have the same stores and inventory and brand as you did the day before, customers keep showing up at your stores and buying stuff, and maybe you cut costs and earn enough to fill the hole in your accounts. Sure you have some long-term debt, and sure the lenders say you are in default and demand their money back, but you can fight that in court for a while. It’s not like you have depositors who can take out all their money at the first hint of fraud.

But a lesson here is that, deep down, lots of companies are actually levered financial institutions subject to run risk. Americanas doesn’t just sell stuff to customers for money that it uses to pay for more stuff; it sells stuff to customers on credit and then borrows against the receivables to pay its bills. It funds itself with short-term borrowing, that could dry up overnight, and did. Because it did a fraud, and because it told everyone.